As Rachel Reeves ponders her forthcoming budget and how to balance raising money against economic growth, one of her self-imposed constraints is her pledge not to raise the rate of VAT. However the impact of taxes also depends greatly on the thresholds from which they apply, even though this tends to get a lot less attention in public debate (as is certainly the case for income tax).

So what about the annual turnover level at which businesses have to register for VAT?

Data I have recently obtained from HMRC under the freedom of information law shows the dramatic impact of the VAT threshold in restricting the growth of some of the UK’s small businesses.

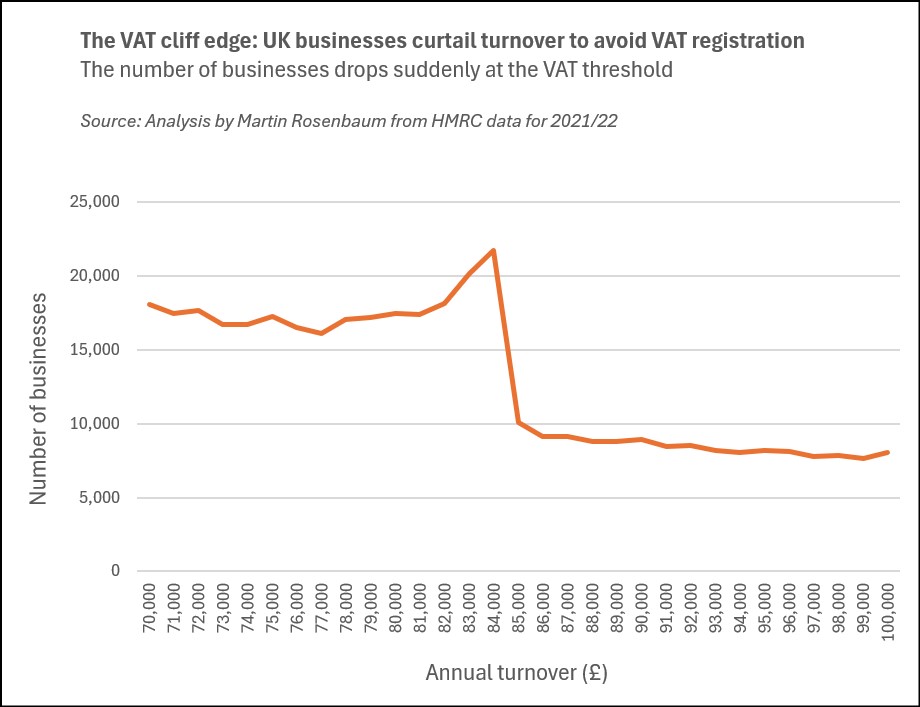

In 2021/22 the UK had 21,752 businesses with annual turnover in the range £84,000-£85,000, just below the then threshold. But there were only 10,096 businesses just over the limit, in the range £85,000-£86,000.

In other words the number of businesses clustered just under the VAT threshold was more than double the number just above, as businesses curtail their activities to remain outside the VAT registration system.

The graph above clearly shows the cliff edge in the data.

Many small businesses are desperate to keep their annual turnover under the VAT level, so that they avoid the bureaucracy and costs of registration and they don’t have to charge VAT to customers, which would make them less competitive. However the consequence is that they then won’t grow further into larger, more successful operations.

For some businesses the VAT threshold functions as a ceiling constraining their growth.

Research by Warwick University in 2022 concluded that earlier data of this kind reflected genuine curtailment of business activity rather than false reporting to HMRC.

This is the latest data available from HMRC, which says that more recent information is still being processed. The current VAT threshold is now £90,000, as the figure was increased by the Conservative government before the general election.

The UK’s VAT threshold is high compared to other European countries which tend to impose VAT registration on businesses at a much lower level. While the UK policy saves many small businesspeople from the compliance burden of VAT, the significantly lower thresholds elsewhere make it less likely that enterprises will be found bunched and held back just under the relevant level of turnover.

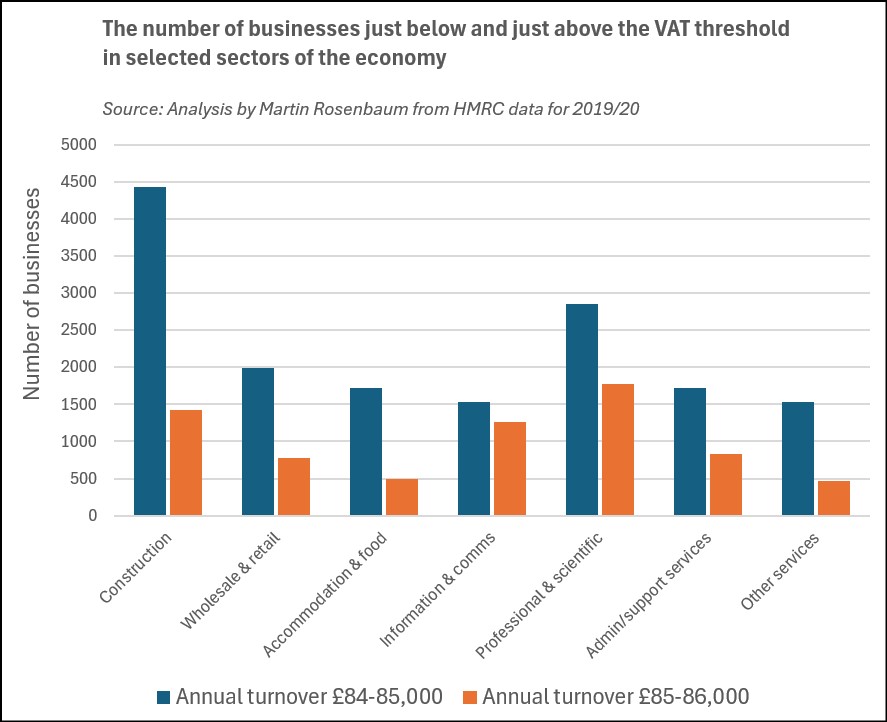

I also wanted to get a breakdown of the data by sector of the economy, to see which kinds of businesses were most affected. HMRC said it could provide this for 2019/20, as it had previously extracted the information involved, but that more recent breakdowns would probably exceed the FOI cost limit.

According to these 2019/20 figures, the most dramatic effect is in the construction sector.

This data shows 4,445 construction businesses with an annual turnover of £84,000-£85,000, but only 1,425 in the range £85,000-£86,000. So the number of construction businesses appearing to have kept themselves just below the limit is over three times the number who grew a little more and just exceeded it.

The chart shows the impact for construction and some other economic sectors with large numbers of small enterprises.

These FOI releases from HMRC constitute the latest and most thorough official evidence of what the tax expert Dan Neidle of Tax Policy Associates has called ‘the VAT growth brake’.

The full HMRC spreadsheets can be downloaded here: